Social media and risk managers are still not words often heard together. As I prepared for my Risk and Insurance Management Society (RIMS) 2015 session entitled, “Watch this: Social media's impact on claims strategies,” I became increasingly aware of the impact social media can have in our industry. I sought to understand why social media is important in risk management and, in particular, how it can enhance the customer experience.

At Sedgwick, we play an active role in social media and believe that being part of the online conversation is important to not only improve the consumer (claimant) experience, but also to enhance our brand reputation and that of the clients we represent. Working with our social media team, I have become a believer in the power and potential social platforms can play in the risk management/insurance industry.

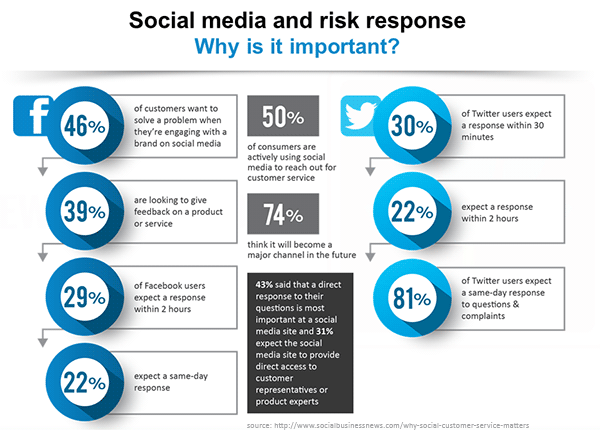

We live in a hyper-connected world where we hold amazing amounts of data and the ability to connect in real time in the palms of our hands. As consumers ourselves, you have to admit you are probably becoming increasingly impatient when you don’t receive customer service in minutes using a mobile device. The same is true in our industry; the world never sleeps and no matter where you operate someone is looking to connect with you about a claim or other risk-related matter.

I only have to give you a few facts to emphasize that social media is king. The Pew Research Center reported in a study released on January 15, 2015 the following demographics of social platform users:

- 71% of online adults use Facebook

- Usage among those age 65 and above rose from 45% to 56% since 2013

- The fastest-growing platform is Instagram, seeing almost every demographic grow; most notably, usage by 53% of young adults 18-29 is up from 37% in 2013

In my session, we are covering the typical aspects of how you can use social forensics to track those who are committing fraud. This in itself is fascinating as we see that people can’t help but share information about themselves. This includes incriminating evidence trails left on social sites. There is still much to learn about what and when this type of social forensics can be used.

Proactive customer experience

What I really want to talk about, however, is promoting a proactive customer experience. There is so much opportunity to preemptively prevent a claimant from becoming angry or frustrated. I believe one of the main reasons claims go into litigation is poor communication. Social media is the new age of communication and it is imperative we all join in. The fact is the conversation is happening in the social space – with or without you.

I know you are saying, “but Scott, we are not a B2C company where the general public would complain if they didn’t get their food order or products delivered correctly.” My answer is, you are still in the customer service business. In today’s fast-paced world, consumers of both products and services want to know that the companies they rely on will respond on social media in as little as 30 minutes. Today when a consumer is not happy, what do they do? They often turn to Twitter, Facebook, Instagram or another social channel to vent their unhappiness. By responding and seeking to take the conversation offline in pursuit of resolution, you succeed in letting that consumer know you are listening. In many cases at Sedgwick, we find that is a huge step in diffusing frustration.

Brand reputation management

The next reason to engage through social media is your company’s brand reputation. When you can address negative comments and not allow those to grow, you are protecting your brand. Again you might be saying to yourself, “Scott, we work in risk management – not marketing or social media.” I say, then you need to start finding out if your company has a team of people who are already listening or monitoring your brand and what is being said about your company. If they are not, then there are some inexpensive methods (including dashboard tools, like Hootsuite, Buffer or Sprout Social, or search tools, like Google Alerts) that you can use to at least listen to what is being said about you. If possible, respond and react in real time or partner with your social media or marketing team to be notified in a timely manner about negative comments online.

The truth is that even major brands are still adapting to living in a hyper-connected world. So although the risk and insurance industry as a general rule has been behind, we are all catching up quickly. I encourage you to start with small steps and explore ways you can become more proactive in your social customer experience.

Please feel free to leave your thoughts and comments here. Better yet, let me practice what I preach and follow me or Sedgwick on Twitter and ask your questions there. I can be found @sprogers68 or @Sedgwick. I look forward to proactively discussing this topic with you.

Scott Rogers, EVP, Casualty Operations